Upper Floor Feasibility Study

415 Adams Street, Springfield IL

Project Summary

The project will add a total of eight residential units to the second and third floors. There is a fourth and fifth floor on the rear half of this property that has not been included in the real estate Pro forma.

Existing Condition

The property was previously used for office use and was renovated in the 1970s including an elevator and major new mechanicals and finishes. There is also a rear freight elevator. This building has a deep floor plate (140 ft) which makes this a challenge for a typical residential conversion. The proposed design uses and open floor plan with only the walls dividing the units going from the floor to ceiling. The interior unit walls would only go to eight feet, which has two benefits. 1: It allows the use of ”borrowed light and air” to the interior bedrooms and makes it easier to preserve the historic tin ceilings. 2: The rear of the building has large openings in the masonry to allow for a rear balcony for the two rear units with a full glazed wall for maximum interior lighting.

Construction Notes

The building has two means of egress and a full fire suppression system as well as elevator service to the second and third floors. The residential use is permitted in the downtown area and does not require any on-site parking. This fourth and fifth floor spaces also have the potential for residential re-use, which would benefit from the conversion of the rear freight elevator to residential capacity.

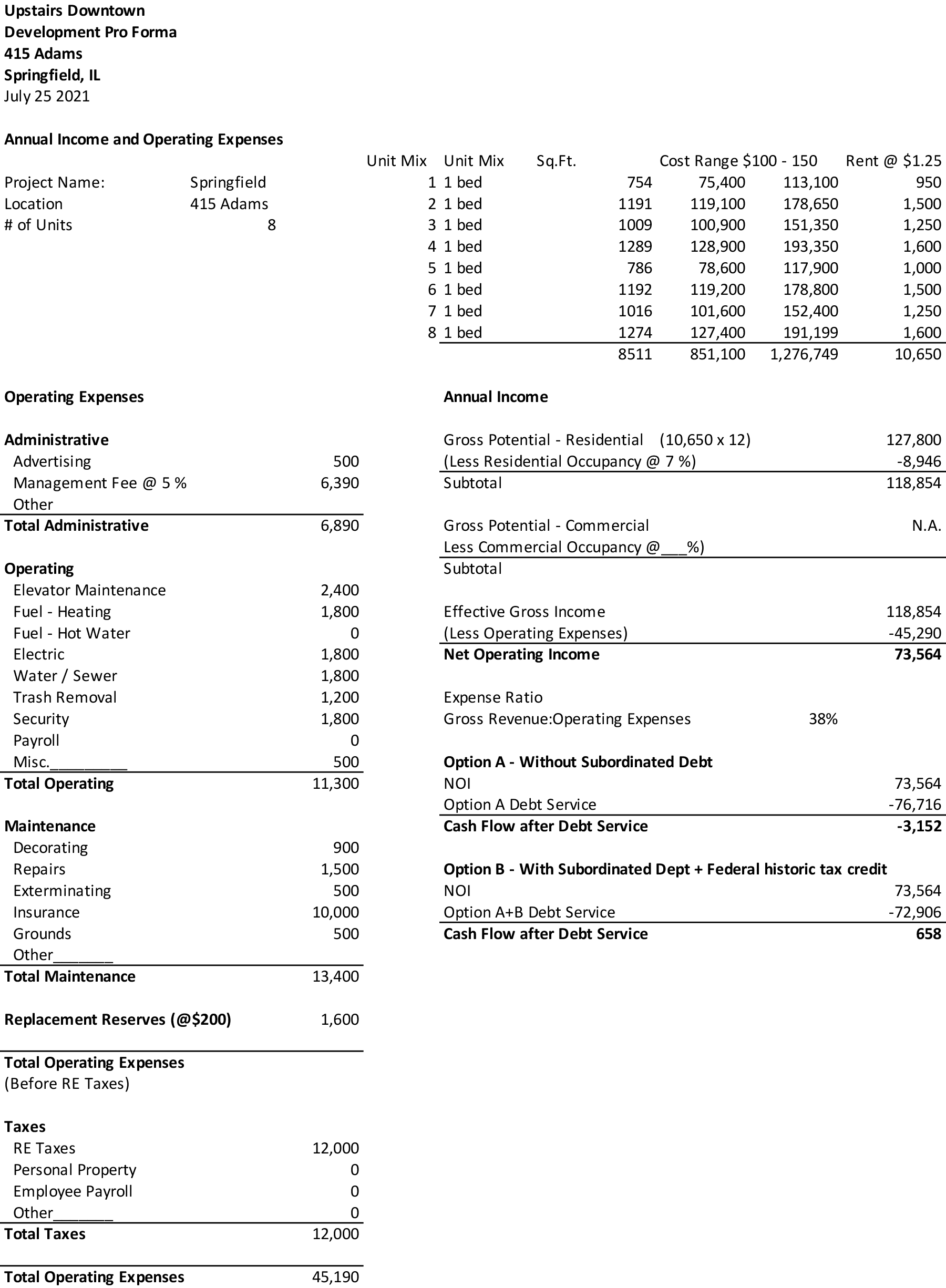

Real Estate Development Pro Forma

415 Adams Assumptions

Rental rates of $1.25 per square foot.

Third party property management at 5% of gross revenue. 7% vacancy rate typical for emerging urban markets.

Operating expenses at 38%.

Sources and Uses

Owner capital of 20% without subordinated debt, 10% with subordinated debt. First position financing at 3.5% interest with a 25-year amortization.

Hard construction costs $115 p.s.f. based on market pricing. Soft costs $25 p.s.f. based on construction expertise of owner.

Gap financing in the form of a CDFI loan with interest only payments for seven years at 1.5%. Gap financing allows first mortgage to be paid off faster (15 vs. 25-year amortization).

Gap financing in the form of Federal Tax Credits purchased by CDFI at closing valued at 12% of total capitalized costs net present value.

Refinancing in year eight to payoff original first position loan and CDFI loan.